BY Darron Gill, Advisory Partner, Healthcare, Houston AND Britni Barsness, Advisory Director, Financial Due Diligence

BY Darron Gill, Advisory Partner, Healthcare, Houston AND Britni Barsness, Advisory Director, Financial Due Diligence

Here we are again with the dawn of a new year, and questions regarding what 2024 will bring for dealmakers in healthcare and life sciences (HCLS) are front and center in the minds of many. At KPMG, we are happy to present our thoughts around these questions in our 2024 HCLS Investment Outlook (the Outlook). The Outlook is published annually in January and provides an in-depth examination of the HCLS deal market as well as how eight specific subsectors fared in 2023. The Outlook also discusses how the major developments of 2023 could shape the 2024 investment landscape. Contributors to this analysis include KPMG industry experts as well as over 500 respondents to KPMG’s annual survey of corporate and private equity dealmakers.

So, lets first look back at 2023 and then we’ll look forward to the expectations for 2024.

A Look Back to 2023:

The HCLS marketplace began facing significant macroeconomic headwinds last year, including the U.S. Federal Reserve increasing interest rates at a historic pace coupled with persistent inflation. Industry leaders faced substantial uncertainty as they attempted to reposition themselves for strategic growth in the post COVID-19 environment despite sharply higher costs of capital and the looming threat of recession. Many economists projected an imminent recession. As 2023 progressed, however, economic indicators became more muddled as employment reports and consumer spending numbers kept returning higher than expected.

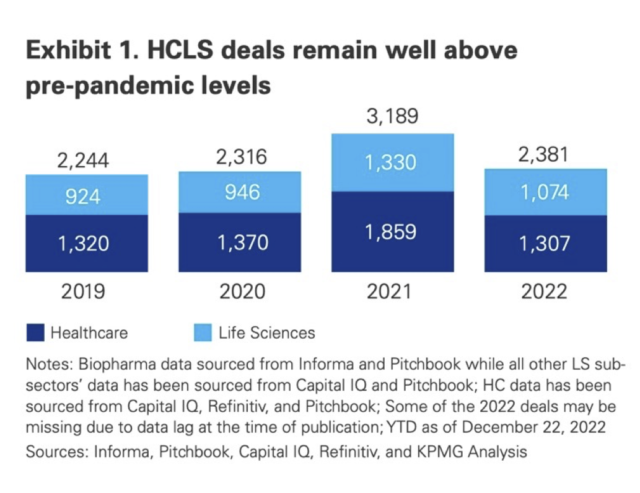

Against that backdrop, annual deal volumes for both life sciences and healthcare dropped compared to 2022 and pre-pandemic levels (see Exhibit 1), with the 4th quarter of 2023 seeing deal volume drop by approximately 21% from the average of the previous three quarters.

Healthcare:

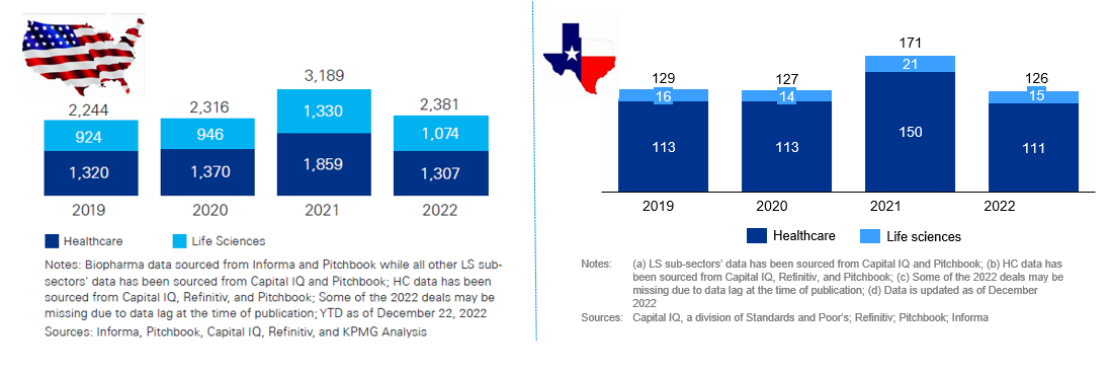

While total healthcare deal volume declined in 2023 (both across the nation and in Texas), strategic healthcare M&A increased 19% and 25% nationwide and in Texas, respectively, from 2022 levels (as shown in the graphs below). This trend was driven by large healthcare companies and health systems seeking to gain scale and share resources to maintain positive margin profiles. Smaller healthcare entities pursued partnerships to provide additional liquidity and flexibility in a difficult financial landscape. This trend of increased strategic investor activity was unique to the healthcare subsector.

Specific Texas activity in this rise of strategic investment included Medical City Healthcare in Dallas (a unit of HCA Healthcare) acquiring Wise Health System and its three TX inpatient hospitals, as well as HCA’s acquisition of Trinity Regional Hospital Sachse, expected to close in January. Other Texas deals include R1 RCM’s acquisition of Houston-based healthcare revenue cycle management company, Acclara at a $675 million valuation.

Challenges that will continue to impact M&A in the healthcare subsector include reimbursement rate pressures, labor cost trends, the shift towards value-based payments and the threat of regulatory changes on the horizon.

Life sciences:

In addition to the aforementioned economic challenges of 2023, life sciences industry leaders grappled with the impact of multiple changes to federal policy as well as rapid innovation, all of which created marketplace winners and losers. In 2023, the Inflation Reduction Act (IRA) was implemented, which required Medicare price negotiations for top-selling prescription drugs. At the same time, the FTC adopted a more stringent anti-competition stance and the Biden administration rolled out a new NIH framework for march-in rights. These disruptors impacted both strategic and financial investors, resulting in a 19% decline in total deal volume from 2022

Despite these challenges, companies with sufficient resources to prepare and defend against FTC objections completed several large acquisitions near year-end. This demonstrates a continued appetite for inorganic growth within the life sciences industry, especially in the area of precision medicine, including innovative cell-and-gene therapies and treatments for cancer and rare diseases.

Key Texas-based life sciences activity during 2023 includes the Biogen Inc. acquisition of Plano-based Reata Pharmaceuticals for $7.3 billion. The deal was announced in July after Reata received FDA approval in February for SKYCLARYS, the first-ever treatment for Friedreich’s ataxia in the US. Other life science deals include Sona Nanotech Inc.’s acquisition of Austin-based Siva Therapeutics, a developer of photo thermal therapy for treatment of cancerous tumors, as well as Aegis Sciences Corp’s acquisition of the toxicology division of HealthTrackRx, a PCR-based infectious disease lab headquartered in Denton, TX.

A Look Ahead to 2024:

As 2023 ended, key macroeconomic concerns started to wane to some extent. With inflation continuing to ease and further interest rate hikes by the Fed appearing less likely, the dealmaking environment may see marked improvement for 2024. Investor outlook is positive, especially as financial investors look to deploy capital that remained sidelined throughout 2023. Approximately sixty-one percent of survey respondents expect deal volumes will grow in 2024, compared to only 9 percent expecting deal volumes to fall.

The expectations around industry valuations are more mixed, with half expecting an increase in valuations compared with thirty percent who think valuations may decline in 2024. The disparity in valuation expectations reflects the bimodal deal market of late, where attractive targets in certain subsectors are achieving higher valuations compared to targets in less competitive processes.

When asked what could impede deal activity for 2024, our respondents cited continued concerns around the economy, but what may play more of an impact is stiff competition for an expected limited number of high value or innovative targets. With so much capital to be put to work, the competitive auction processes for these assets could be stiff.

We hope you will take time to read the full HCLS Outlook for more on the overall HCLS deal market, as well as KPMG’s in-depth subsector analyses for biopharma, diagnostics manufacturing, medical devices, biopharma services, hospitals and health systems, physician practices, healthcare payers, and healthcare IT.