BY Darron J. Gill, Advisory Partner, Healthcare, KPMG

BY Darron J. Gill, Advisory Partner, Healthcare, KPMG

As a partner in KPMG U.S. Healthcare and Life Sciences (HCLS) Deal Advisory practice, I am often asked in the early months of a new year about what is happening in the deal market and what I am expecting for the new year. More voices discussing a topic is better than one, so the KPMG U.S. Deal Advisory practice has been publishing its HCLS Investment Outlook every January for the past few years.

The 2023 HCLS Investment Outlook is an in-depth examination of the HCLS industry that explores the major developments of 2022 and the expected sources of turbulence in 2023. In addition to looking at the overall HCLS industry, the HCLS Outlook further analyzes how eight subsectors fared during the macroeconomic and geopolitical upheaval of 2022 and how deal activity and market drivers could shape the 2023 investment landscape. The HCLS Outlook includes not only the voice of KPMG but also extensive global research in the deal and market environments and KPMG’s annual survey of corporate and private equity dealmakers.

So, what is the HCLS Outlook telling us this year?

What happened in 2022

HCLS investors started 2022 with optimism. More than 70 percent of the industry and private equity leaders in the 2021 HCLS Outlook expected increasing M&A activity in 2022 because of the historically low cost of capital and internal pressures to put funds to work. And this was the case in the first quarter when investment, although lower than the frenzied market of 2021, was still about 21 percent higher than in the same period in 2019, representing a more normalized deal environment.

However, the same quarter brought another winter COVID-19 surge, straining the resources of hospitals, physician practices, and life sciences companies. February 2022 brought the Russian invasion of Ukraine, jolting the global economy and fueling inflationary pressures as energy prices spiked and international supply lines were disrupted. In March, the U.S. Federal Reserve started a series of interest rate hikes that were among the steepest in history. Further, while potential acquisition targets were still expecting the high valuations that had prevailed in 2021, investors became selective in their pursuits. A few subsectors got back to the high point of the first quarter as the year progressed.

Furthermore, the passage of the Inflation Reduction Act of 2022 is expected to have a significant impact on the HCLS industry. Starting in 2023, the law requires Medicare price negotiations for top-selling prescription drugs. The new rules are already impacting revenue forecasting and valuation of assets in biopharma and will likely shape research decisions and spur transactions as companies assess their pipelines and product portfolios.

Despite all these challenges, there was rapid innovation and strategic repositioning by companies in many subsectors. Dealmaking continued, often in the form of smaller acquisitions, partnerships, and licensing agreements. In many cases, these deals were designed to increase investment as research, development, and marketing milestones were achieved. Inflation, high borrowing costs, and an impending recession affected various subsectors and companies in different ways, depending on their resilience to economic downturns and the availability of cash for acquisitions.

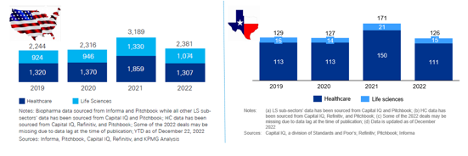

In 2022, the number of deals in both healthcare and life sciences was similar to pre-pandemic levels in Texas and across the nation, as shown in the graph below. Texas also saw some marquee deals in 2022, including CVS Health Corporation’s $8.1 billion acquisition of Signify Health, a home health player based in Dallas.

What’s ahead in 2023

The outlook for 2023 remains positive among survey respondents. It is expected that deal volumes will grow in 2023 even as economic conditions become more challenging and other industry headwinds remain. Sixty percent of respondents in the HCLS Outlook expect more deals in 2023 than in 2022, and only 8 percent predict that deal volume will fall. A projected decline in industry valuations could help propel strategic and financial investments.

However, challenges will remain. Concerns about inflation and rising interest rates, competition for the most valuable targets, and other factors will likely impact deal plans and activity throughout the year ahead.

Please see the full HCLS Outlook for more on the overall HCLS deal market, as well as KPMG’s in-depth subsector analyses for biopharma, diagnostics, medical devices, biopharma services, hospitals and health systems, physician practices, home healthcare and hospice, and healthcare IT.