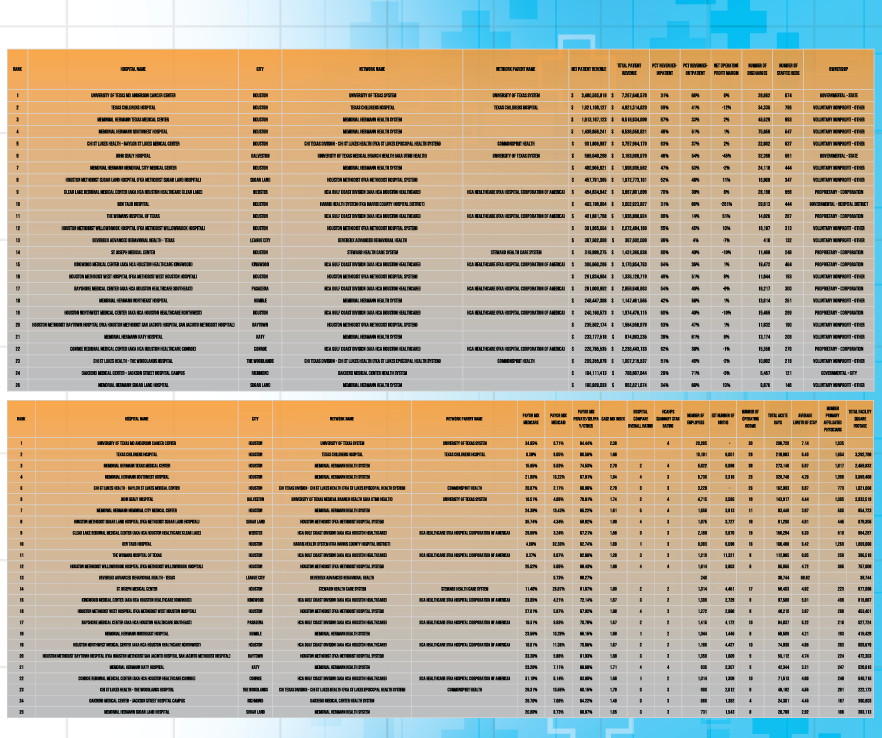

For the third year in a row, the top Houston-area hospitals reported average outpatient revenues that account for nearly half of all revenues, not quite overtaking revenues generated by inpatient services despite the continued focus on outpatient centers and services across the healthcare industry. According to Similarly, the average inpatient revenue ratio also rose from just over 50 percent of total revenues to more than 63 percent since last year. The increase could be due to several factors, though the most likely is that there are certain procedures that the Centers for Medicare and Medicaid Services (CMS) has approved to be performed in an outpatient setting, leaving the majority of surgical procedures to the inpatient setting.

There does not seem to be any correlation between a hospital’s net patient revenue and other metrics, such as number of discharges, ownership, or patient length of stay. Of the top 25 Houston-area hospitals by net patient revenue, only three reported fewer than 10,000 discharges in CY 2017. The average number of discharges for all 25 hospitals is just over 21,000. Memorial Hermann Southwest Hospital reported the greatest number of discharges with 75,859, but only ranks 4th on our list by highest reported net patient revenue. University of Texas MD Anderson Cancer Center, which has the highest reported net patient revenue, ranks 6th for greatest number of discharges. The hospital with the fewest reported discharges is Devereaux Advanced Behavioral Health with 410, which ranks 13th by net patient revenue.

There does not seem to be any correlation between a hospital’s net patient revenue and other metrics, such as number of discharges, ownership, or patient length of stay. Of the top 25 Houston-area hospitals by net patient revenue, only three reported fewer than 10,000 discharges in CY 2017. The average number of discharges for all 25 hospitals is just over 21,000. Memorial Hermann Southwest Hospital reported the greatest number of discharges with 75,859, but only ranks 4th on our list by highest reported net patient revenue. University of Texas MD Anderson Cancer Center, which has the highest reported net patient revenue, ranks 6th for greatest number of discharges. The hospital with the fewest reported discharges is Devereaux Advanced Behavioral Health with 410, which ranks 13th by net patient revenue.

Interestingly, University of Texas reports the third-highest patient length of stay of the hospitals listed, following Devereaux and the Woman’s Hospital of Texas. Facilities with longer patient stay lengths are generally associated with greater instances of hospital-acquired conditions (HACs) such as sepsis and pressure ulcers. The care facilities reporting the greatest percentages of these HACs face financial penalties from CMS, as well as potentially higher readmission rates and lower patient satisfaction scores – all of which negatively impact the financial performance of a hospital. On the other end, Memorial Hermann Sugar Land Hospital reported the shortest patient stay length, which should be beneficial to its overall financial performance, yet it ranked last on the list by net patient revenue. This could be due to the relatively low number of patient discharges reported, as the hospital ranks 23rd of 25.

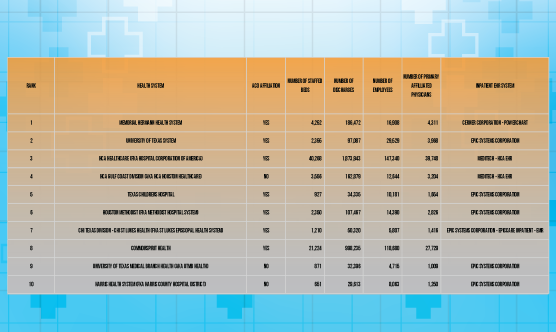

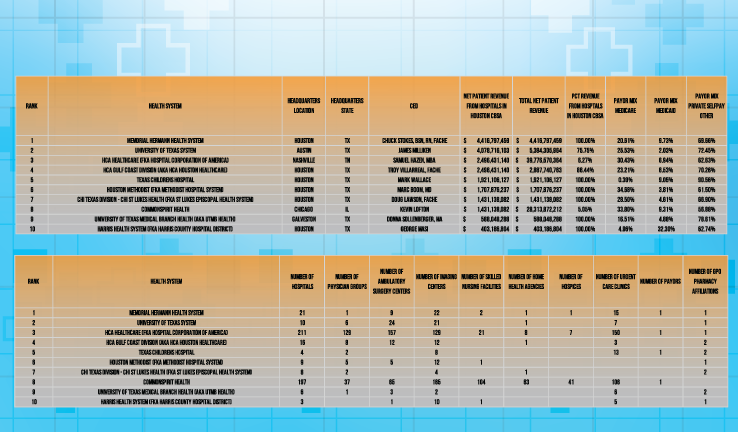

Unlike with the top Houston-area hospitals by net patient revenue, there does seem to be a telling metric that determines the top Houston-area health systems: the number of facilities within the system. The top 10 health systems, ranked by net patient revenue earned from Houston-area hospitals, are primarily based in Texas. Only two, HCA Healthcare and CommonSpirit Health, are based in other states: Tennessee and Indiana, respectively. Excluding the multi-state systems, the number of hospitals owned by a health system does seem to contribute to its overall ranking. The top three Texas-based health systems by net patient revenue – Memorial Hermann Health System, University of Texas System, and HCA Gulf Coast Division – report owning 10 or more hospitals. Each of these systems also reports owning upwards of 10 imaging centers. Both University of Texas and HCA Gulf Coast also report owning more than 10 ambulatory surgery centers, which could be major contributors to the systems’ large net patient revenues through expanded care offerings.